Brian George- President and CEO

Supreme Ventures

The Trinidadian head of Supreme Ventures Limited (SVL) Brian George was previously Senior Director of GTECH Latin America and General Manager of GTECH Jamaica and Barbados. As General Manager of GTECH Jamaica, he had been working closely with SVL even prior to the launch of operations in 2001.

He gained considerable marketing insight and management expertise through his over 18 years of experience in the gaming industry.

He is a graduate of Tulane University with a degree in Physics who also pursued various management development programs, including Executive Development programs at Stanford University.

The following edited extract was taken from the company’s Annual Report to shareholders.

2014 Was The Year For Expansion

The Jamaican economy was relatively stable in 2014 with key macroeconomic variables moving in a positive direction.

The Jamaican gaming market (inclusive of illegal gaming) is estimated to have a potential value of between J$75-J$100 million. The estimated size of the country’s legal gaming market for the fiscal year 2013/2014 was J$43 billion.

The Group currently operates in a:

• Non-competitive legal lottery market (currency lottery remains in effect to year 2033)

• Competitive sports betting market

• Competitive VLT market

In 2014, there were three significant legislative/regulatory changes which directly impacted the operations of the Group and the industry overall.

The first was the introduction of new regulations governing telephone betting which was provided for operators to establish accounts for players/ customers who can now transact business via mobile or landline telephone.

The second was the implementation of an amendment to the Proceeds of Crime Act (POCA) which now applies to operators of VLT gaming lounges.

The third was the amendment to the Betting Gaming and Lotteries Act which allowed for the expansion of our Sports Betting agents as being separate from bookmaking operators.

These legislative and regulatory changes were positive for the industry and serve to facilitate the development of a vibrant gaming landscape going forward.

Our strategic objectives for 2014 were: expansion of our portfolio of lottery games; expansion of our sports betting distribution network and elimination of non – profitable operations. During the period we made significant strides in achieving these targets, resulting in improved value to our stakeholders.

In addition to the changes made in the core business, the Group also realized gains in administrative efficiency from restricting the location of its corporative administrative functions.

The foregoing strategic initiatives were instrumental in the Group’s improved performance for 2014.

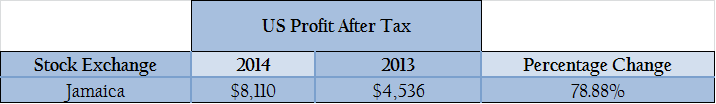

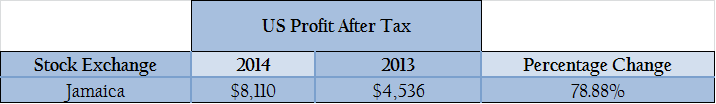

For 2014, the Group recorded $929.917 million in net profit an increase of approximately 93% above the $482.569 million reported for 2013. This improved profit performance was achieved through strong revenue growth and effective cost management.

The Group improved its operating efficiency in 2014, converting its gross profit gains into increased profits from operations by reducing its operating expenses.

Supreme Ventures expects 2015 to be another year of growth and improvement in all our business segments.

Businessuite News24 International2 years ago

Businessuite News24 International2 years ago

Feedback & What You Think2 years ago

Feedback & What You Think2 years ago

Marketing & Advertising2 years ago

Marketing & Advertising2 years ago

Businessuite Women1 year ago

Businessuite Women1 year ago

Businessuite 50 Power and Influence1 year ago

Businessuite 50 Power and Influence1 year ago

Leadership Conversations1 year ago

Leadership Conversations1 year ago

Businessuite Markets2 years ago

Businessuite Markets2 years ago

RANKING7 months ago

RANKING7 months ago