Ravi Tewari

Guardian Holdings Limited

Ravi Tewari has over 20 years experience in the life, health and pensions industry including over 12 years experience as a senior executive. As an Island Scholar of Fatima College he earned a First Class Honours Degree from Cass Business School, London. On his return to Trinidad he worked as a pensions and life-insurance consultant at Buck Consultants where he rose to be Head of Life Consulting. In this capacity he provided comprehensive actuarial services for four life insurance companies spanning Trinidad, Barbados and Guyana. He moved to Guardian Life in 1999 as Valuation Actuary and was soon made Appointed Actuary. In that capacity he was heavily involved in Guardian’s major acquisitions in Jamaica and the Dutch Caribbean that transformed Guardian from a Trinidadian insurer to a regional insurer. He was appointed President of Guardian Life in 2005 and successfully deployed a campaign to modernize Guardian’s infrastructure and dramatically enhance Guardian’s technical performance in the face of declining interest rates and a sharp decline in the Trinidad stock market. In 2009 he was appointed Group President – Life, Health and Pensions where his mandate was to oversee the operations of all life companies in the Guardian Group and to standardize, consolidate and synergize their operations.

The following extract was taken from the company’s Annual Report to shareholders.

The Re-emergence of The Core Business

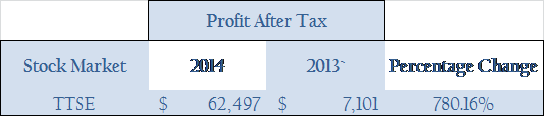

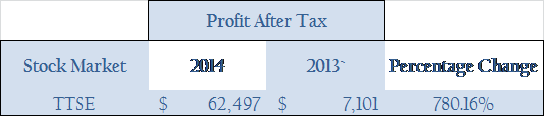

As we alluded in the 2013 Chairman’s and CEO’s statement, 2014 marks the re-emergence of the performance of the core businesses as the key driver in the fortunes of the Group. The Group’s performance for the year 2014 resulted in a Net Profit After Tax Attributable to Shareholders of $400.5 million, an increase of 779%, as compared to 2013 when we wrote down our Pointe Simon asset. Consequently, earnings per share for 2014 are $1.73 as compared to $0.20 in 2013.

I am pleased to report we have had many successes in commercialising Pointe Simon over 2014. The specifics of the different aspects of the development are set out below:

• We have concluded sales transactions for 35 of the 45 condominium units. This includes the sale of 25 units under a block transaction, taking advantage of an incentive available under the French tax regime. We expect to secure outright sales of the remaining units during 2015.

• The rental of the office tower is progressing according to our marketing plan. Having closed a number of leases we expect to move towards full occupancy by the end of 2015.

• The hotel, which is scheduled to open in the last quarter of 2015, was sold to a Martinique incorporated company known as SAS Compagnie Hôtelière de la Pointe Simon (CHPS) for €21.16 million generating a profit of €1.1 million. The Group provided vendor financing for the sale while retaining a 24% interest. The vendor financing is interest bearing and is fully secured by the hotel. It has already been reduced by €3.5 million and will be reduced by a further €3.8 million before the end of 2015.

• Negotiations for the rental of th e retail space are progressing well. We expect near full occupancy by premiere retail and entertainment brands to coincide with the opening of the hotel.

Despite the dearth of long-term government securities we continue to hold a diversified investment portfolio by asset class, currency and country. Through this diversification we aim to strike a balance between mark-to-market movements, currency fluctuations and attractive returns despite the low interest rate environment. Fair Value Gains were offset by unfavourable currency movements and persistent low interest rates, producing total contribution from Investing Activities of $923.3 million, an overall increase of $65.5 million over 2013.

Having addressed volatility in non-core activities, management is now able to put renewed focus on growing our core businesses by leveraging our strong insurance franchises to increase revenue and profits.

Businessuite News24 International2 years ago

Businessuite News24 International2 years ago

Feedback & What You Think2 years ago

Feedback & What You Think2 years ago

Marketing & Advertising2 years ago

Marketing & Advertising2 years ago

Businessuite Women1 year ago

Businessuite Women1 year ago

Businessuite 50 Power and Influence1 year ago

Businessuite 50 Power and Influence1 year ago

Leadership Conversations1 year ago

Leadership Conversations1 year ago

Businessuite Markets2 years ago

Businessuite Markets2 years ago

RANKING2 years ago

RANKING2 years ago