Businessuite Markets

JMMB Group Posting 2017 Net Profits of J$3.35 Billion On Operating Revenues J$14.6 Billion A 28.2% Increase Over 2016 – Duncan

Businessuite Markets

QWI Investments Performance Characterized By Strong Performance In Overseas Portfolios

Businessuite Markets

Prestige Holdings Enjoyed A Strong Performance For First Quarter Of Fiscal 2024.

Businessuite Markets

GraceKennedy’s Strategic Spur Tree Spices Acquisition: Positioning For Growth

Businessuite Markets

MFS Capital Partners successfully completes 100% acquisition of Microfinancing Solutions Limited.

Businessuite Markets

ANSA McAL Group Announces Formation Of Joint Venture Company, Globus ANSA Private Limited, With Globus Spirits Limited In India.

-

Businessuite News24 International2 years ago

Businessuite News24 International2 years agoTELSTRA Officially Acquires DIGICEL PACIFIC

-

Feedback & What You Think2 years ago

Feedback & What You Think2 years agoWhich Company Has The More Sustainable Business Model….Edufocal or ICREATE and Why?

-

Marketing & Advertising2 years ago

Marketing & Advertising2 years agoWill Oliver Mcintosh’s Verticast Media Group Acquire CVM TV From Michael Lee Chin? Part 1

-

Businessuite Women1 year ago

Businessuite Women1 year agoJoanna A. Banks Was Set To Become The Youngest And Most Powerful Woman In Corporate Jamaica And The Caribbean

-

Businessuite 50 Power and Influence1 year ago

Businessuite 50 Power and Influence1 year agoBusinessuite Women- Power and Influence 50 For 2023

-

Leadership Conversations1 year ago

Leadership Conversations1 year agoJeffrey Hall Is Set To Be One Of The Most Powerful Men In Corporate Jamaica And The Caribbean. So, Who Is He?

-

Businessuite Markets2 years ago

Businessuite Markets2 years agoWhat Does Seprod’s Acquisition of Trinidad Based A.S. Bryden Have to Do with CEO Richard Pandohie’s Single Domestic Market Strategy?….Part 1

-

RANKING2 years ago

RANKING2 years agoThe Businessuite Skin Index – Explained

QWI Investments (QWI) continued the fiscal year ending September 2023 with a favourable second quarter profit before tax of $74.4 million versus a loss before tax of $27.8 million.

QWI Investments (QWI) continued the fiscal year ending September 2023 with a favourable second quarter profit before tax of $74.4 million versus a loss before tax of $27.8 million.

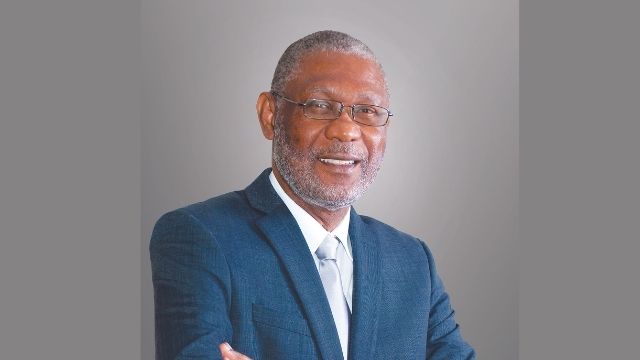

I am pleased to report that Prestige Holdings enjoyed a strong performance for the First Quarter of fiscal 2024. Group sales increased by 10% to $341 million from $309 million in the prior year, which resulted in a Profit Before Tax of $15.3 million compared to a profit of $11.6 million for the same period in 2023, a 32% increase. Profit After Tax, attributable to shareholders, increased by 25% from $7.8 million to $9.8 million. Cash flow from operations was $26.9 million and we ended the quarter with $100 million in cash having reduced total borrowings by $5.8 million. During the period we remodelled 2 restaurants and ended the period with 134 restaurants.

I am pleased to report that Prestige Holdings enjoyed a strong performance for the First Quarter of fiscal 2024. Group sales increased by 10% to $341 million from $309 million in the prior year, which resulted in a Profit Before Tax of $15.3 million compared to a profit of $11.6 million for the same period in 2023, a 32% increase. Profit After Tax, attributable to shareholders, increased by 25% from $7.8 million to $9.8 million. Cash flow from operations was $26.9 million and we ended the quarter with $100 million in cash having reduced total borrowings by $5.8 million. During the period we remodelled 2 restaurants and ended the period with 134 restaurants. I am extremely pleased to report that KFC recently achieved a significant milestone of serving 150,000 Harvest Meals. The Harvest Meal Programme, which has been active for two years, is designed to provide unsold KFC food to participating NGOs in Trinidad and Tobago. This unsold food is carefully packaged and transported, following accepted global food safety protocols, and is then repurposed into delicious meals and served to the less fortunate. We are very happy to have the opportunity to positively impact the communities in which we operate by partnering with NGOs to provide meals to those in need.

I am extremely pleased to report that KFC recently achieved a significant milestone of serving 150,000 Harvest Meals. The Harvest Meal Programme, which has been active for two years, is designed to provide unsold KFC food to participating NGOs in Trinidad and Tobago. This unsold food is carefully packaged and transported, following accepted global food safety protocols, and is then repurposed into delicious meals and served to the less fortunate. We are very happy to have the opportunity to positively impact the communities in which we operate by partnering with NGOs to provide meals to those in need.

GraceKennedy’s increased stake in Spur Tree Spices not only strengthens its position in the spice market but also opens doors for collaboration and synergies between the two entities. As GraceKennedy continues to expand its presence through strategic acquisitions, it can leverage Spur Tree’s innovative product line-up to bolster its offerings and tap into new market segments.

GraceKennedy’s increased stake in Spur Tree Spices not only strengthens its position in the spice market but also opens doors for collaboration and synergies between the two entities. As GraceKennedy continues to expand its presence through strategic acquisitions, it can leverage Spur Tree’s innovative product line-up to bolster its offerings and tap into new market segments.

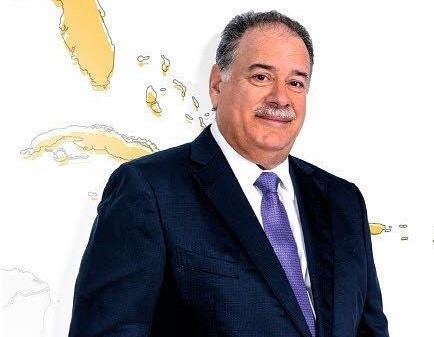

Globus Spirits Ltd is one of the leading players in the Alcohol industry in North India distributing brands in the Consumer Segment including:

Globus Spirits Ltd is one of the leading players in the Alcohol industry in North India distributing brands in the Consumer Segment including: renowned brands, including some of their own home-grown successes. The partnership marks a significant milestone in ANSA McAL Group’s journey, merging cultures and expertise to revolutionise the beer industry in India, with their icon Carib brand and leading the charge.

renowned brands, including some of their own home-grown successes. The partnership marks a significant milestone in ANSA McAL Group’s journey, merging cultures and expertise to revolutionise the beer industry in India, with their icon Carib brand and leading the charge.