• Mr. Tyrone Wilson, who currently serves as Chairman, President & CEO of Kintyre Holdings (JA) Limited, and Chairman of Visual Vibe, has formally assumed the additional role of Chief Executive Officer of Visual Vibe, a wholly owned subsidiary of the Company.

• Ms. Jasmin Aslan has been appointed as Chief Business Officer (CBO) of Kintyre Holdings (JA) Limited, effective July 1, 2025.

• Mr. Andrew Wildish has resigned from his role as Chief Investment Officer of Kintyre Holdings (JA) Limited, effective June 30, 2025. The Company’s investment strategy will now be assumed by Chairman, President & CEO Tyrone Wilson, and will be supported by the Investment Committee of the Board, chaired by Mr. Nick Rowles-Davies.

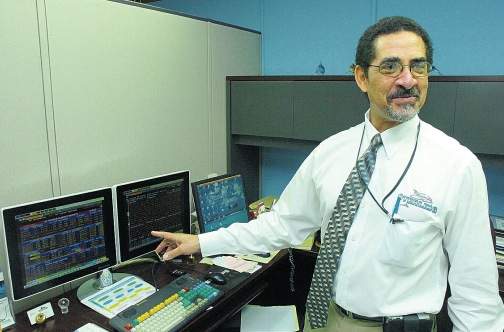

When Mr. Tyrone Wilson, Chairman, President, and CEO of Kintyre Holdings (JA) Limited, stepped into the additional role of Chief Executive Officer at Visual Vibe—alongside his existing portfolio—industry observers took note. His move, following the resignation of Chief Investment Officer Andrew Wildish, now consolidates strategic, operational, and governance control under one leader across the two connected companies.

When Mr. Tyrone Wilson, Chairman, President, and CEO of Kintyre Holdings (JA) Limited, stepped into the additional role of Chief Executive Officer at Visual Vibe—alongside his existing portfolio—industry observers took note. His move, following the resignation of Chief Investment Officer Andrew Wildish, now consolidates strategic, operational, and governance control under one leader across the two connected companies.

While some argue that this concentration of power streamlines decision-making, particularly in smaller or fast-moving firms, global governance standards paint a starkly different picture.

From the UK’s Cadbury Code to the OECD and US Dodd-Frank regulations, best practice guidelines consistently recommend separating the roles of Board Chair and CEO. The rationale is simple: independent oversight safeguards shareholders by ensuring that strategic decisions, executive compensation, and performance evaluations are objectively scrutinized. Harvard Law’s corporate governance research found that dual-role companies often pay more to their top executives and face elevated ESG and accounting risks, with lower long-term returns to shareholders.

In Mr. Wilson’s case, the risks are amplified by his assumption of the departed CIO’s investment strategy responsibilities. While an Investment Committee chaired by Mr. Nick Rowles-Davies will provide support, the absence of a dedicated CIO raises questions about execution bandwidth, focus, and strategic continuity.

His move, following the resignation of Chief Investment Officer Andrew Wildish, now consolidates strategic, operational, and governance control under one leader across the two connected companies.

Recent global examples demonstrate the potential fallout:

At Boeing, CEO Dennis Muilenburg’s dual role contributed to oversight failures during the 737 MAX crisis.

Starbucks faced shareholder pressure to separate Chair and CEO roles held by Kevin Johnson and later Laxman Narasimhan.

At Volkswagen, Oliver Blume’s simultaneous leadership of VW Group and Porsche raised warnings of strategic drift and governance conflict.

For shareholders, these scenarios underline a core truth: Checks and balances matter. Without an independent Chair to challenge decisions, or a standalone CEO focused solely on operational delivery, companies risk poor accountability, strategic blind spots, and diminished investor confidence.

Furthermore, frequent senior departures, as seen with Wildish’s exit, create instability, potentially eroding morale, institutional knowledge, and external credibility. For companies like Kintyre and Visual Vibe, operating in competitive markets requiring agile yet well-governed leadership, the tension between efficiency and accountability has never been more stark.

The path forward? Independent governance experts recommend immediate board-level evaluation of leadership structures to ensure robust oversight. Introducing a non-executive Chair, appointing dedicated executives for strategic verticals, and strengthening board committees are proven routes to balancing entrepreneurial dynamism with fiduciary responsibility.

At the heart of it all lies a question shareholders must ask: When one person wears too many hats, who holds them accountable?

Foot Notes

Governance Best Practices: CEO & Chair Separation

Independence & Oversight

– Combining CEO and Chair roles concentrates power in one person, weakening board oversight and independent challenge

– Governance codes worldwide (UK Cadbury, OECD, Dodd-Frank, etc.) recommend separate roles to avoid conflicts of interest and boost board independence

Costs & Performance

– Studies show companies with dual roles tend to pay more to the leader, exhibit higher ESG and accounting risks, and often deliver lower long‑term returns

Efficiency vs. Accountability

– Proponents argue unified leadership can streamline decision-making, especially in small, fast-moving or crisis settings

– Critics note that efficiency gains are outweighed by weakened accountability, less board challenge, and riskier executive decisions

Risks of Tyrone Wilson Holding Multiple Executive Roles

1. Conflict of Interest & Oversight Blind Spots

As CEO, President, and Board Chair of Kintyre, plus CEO of Visual Vibe, Mr. Wilson controls operational, strategic, and governance levers. This vertical integration drastically reduces independent oversight.

As BoardEvals points out, the Chair should be able to “challenge the CEO’s performance”—impossible when they’re the same person

2. Governance and Shareholder Accountability

– The Board’s duties include setting senior pay and evaluating leadership. With a unified Chair/CEO, Mr. Wilson effectively oversees his own compensation and reviews—undermining fiduciary trust

– Transparency risks arise if disclosures and rationale for dual roles aren’t clearly communicated to shareholders, as required under Dodd‑Frank §972 .

3. Execution Risk & Burnout

Fulfilling multiple demanding roles reduces bandwidth and focus. There’s evidence dual roles can dilute effectiveness and increase error risk .

4. Investor Confidence & Market Perception

– Majority of global investors favor role separation. Even large US firms are moving in that direction (44% of S&P 500 now combined vs. 57% a decade ago)

– Cases like VW (Blume), Starbucks (Niccol), Boeing (Muilenburg) show shareholders raising flags when executives take on both roles

Executive Departures & Instability

Andrew Wildish’s departure as CIO on June 30, replaced by Mr. Wilson & an Investment Committee, indicates a consolidation of high-level roles. Multiple senior exits can signal:

Leadership instability, undermining investor confidence and organizational clarity.

Strategic drift, especially in areas requiring specialized expertise.

Increased “agency” and “entrenchment” risk – where board oversight may be compromised by concentrated executive power .

Shareholder Considerations

Investors should be concerned when:

Checks and balances are diminished

With one executive occupying so many strategic and governance roles, board objectivity may be compromised.

Succession and crisis management are jeopardized

Who leads if Mr. Wilson is unavailable? What happens if rapid decisions are needed? Lack of emergency backup risks business continuity.

Specialized oversight is reduced

Investment strategy, compliance, audit—all risk oversight gaps when not handled by dedicated, independent executives.

External advisors step in

If retained, external governors may mitigate some risks—but at added cost and complexity.

Businessuite Women1 week ago

Businessuite Women1 week ago

Businessuite News243 weeks ago

Businessuite News243 weeks ago

Businessuite News242 weeks ago

Businessuite News242 weeks ago

Businessuite News24 International3 weeks ago

Businessuite News24 International3 weeks ago

Corporate Feature3 weeks ago

Corporate Feature3 weeks ago

Businessuite Markets2 weeks ago

Businessuite Markets2 weeks ago

Business Insights1 week ago

Business Insights1 week ago

Businessuite Women3 weeks ago

Businessuite Women3 weeks ago

2021 saw robust performance in global stock and bond markets as well as record profits for Sterling Investments Limited (SIL). The company was able to generate more income and profit during the depths of the pandemic.

2021 saw robust performance in global stock and bond markets as well as record profits for Sterling Investments Limited (SIL). The company was able to generate more income and profit during the depths of the pandemic.

When Mr. Tyrone Wilson, Chairman, President, and CEO of Kintyre Holdings (JA) Limited, stepped into the additional role of Chief Executive Officer at Visual Vibe—alongside his existing portfolio—industry observers took note. His move, following the resignation of Chief Investment Officer Andrew Wildish, now consolidates strategic, operational, and governance control under one leader across the two connected companies.

When Mr. Tyrone Wilson, Chairman, President, and CEO of Kintyre Holdings (JA) Limited, stepped into the additional role of Chief Executive Officer at Visual Vibe—alongside his existing portfolio—industry observers took note. His move, following the resignation of Chief Investment Officer Andrew Wildish, now consolidates strategic, operational, and governance control under one leader across the two connected companies.

1. Time Becomes Your Most Valuable Currency

1. Time Becomes Your Most Valuable Currency