Dodridge Miller

Sagicor Financial Corporation

Dodridge Miller 57, was appointed Group President and Chief Executive Officer in July 2002, and has been a Director since December 2002. A citizen of Barbados, Mr Miller is a Fellow of the Association of Chartered Certified Accountants (ACCA), and obtained his MBA from the University of Wales and Manchester Business School. He holds an LLM in Corporate and

Commercial Law from the University of the West Indies and, in October 2008, he was conferred with an Honorary Doctor of Laws degree by the University of the West Indies. He has more than 30 years’ experience in the banking, insurance and financial services industries.

Prior to his appointment as Group President and Chief Executive Officer, he held the positions of Treasurer and Vice President – Finance and Investments, Deputy Chief Executive Officer and Chief Operating Officer.

Mr Miller joined the Group in 1989. He is a Director of Sagicor Life Inc, Sagicor USA, Sagicor Group Jamaica Limited, Sagicor Life Jamaica, Sagicor Investments Jamaica Limited (formerly Pan Caribbean Financial Services) and a number of other subsidiaries within the Group.

The following extract was taken from the company’s Annual Report to shareholders.

Revenues from continuing operations in 2014 totalled US $1,045 million, and were US $6 million higher than the prior year amount of US $1,039 million, and included US $29.1 million in negative goodwill on the acquisition of a banking operation in Jamaica. Revenues were also impacted by lower annuity premiums written in the United States, when compared with 2013.

Insurance and other benefits also decreased in 2014 to a total of US $542 million, compared to a total of US $593 million in 2013. This reduction was largely as a result of lower annuity business written in the United States of America as indicated above. Expenses and taxes increased and reached US $403 million in 2014, as compared to a total of US $366 million in 2013. Expenses now include 6 months of operating costs on the banking business acquired in Jamaica, as well as nonrecurring restructuring and rebranding costs.

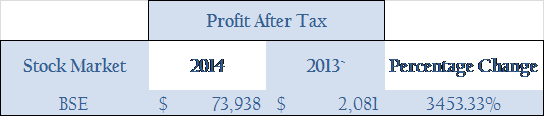

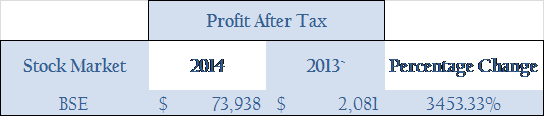

Total comprehensive income from continuing operations increased significantly to US $107 million in 2014, compared to US $6 million in 2013.

Other comprehensive income was US $7 million, compared to a loss of US $74 million in 2013. Comprehensive income in 2014 was impacted by US $16 million in net movements related to investment assets, gains on defined benefit plans of US $13 million, and losses on foreign currency retranslation of US $22 million.

In December 2012, the Board and Management made a decision to dispose of Sagicor Europe, which owned the Sagicor at Lloyd’s operations. In accordance with International Financial Reporting Standards, the results of Sagicor Europe have been separated from the Group’s continuing operations and presented as a discontinued operation. Sagicor Europe was sold on December 23, 2013. The results of the Group’s continuing operations are further analysed under the next several sub-headings. The results of the discontinued operation are discussed and analysed in the Operating Segments section.

The Group’s net income and comprehensive income are allocated to the equity owners of the respective Group companies in accordance with their results. As some Group companies have minority shareholders, particularly in the Sagicor Jamaica operating segment, the Group’s net income is allocated accordingly between holders of Sagicor’s common shares and the minority interest shareholders. There is also an allocation to Sagicor Life Inc’s policyholders who hold participating policies, an arrangement which was established at the demutualisation of Barbados Mutual Life Assurance Society (now Sagicor Life Inc).

For the 2014 financial year, US $54 million of net income from continuing operations was allocated to the holders of common shares of Sagicor Financial Corporation, which corresponded to earnings per share of US 17.3 cents. The comparative amounts for 2013 were US $39 million of net income and earnings per share of US 12.5 cents.

The respective annual returns on shareholders’ equity were 11.2% for 2014 and 7.7% for 2013.

Dividends declared to common shareholders in respect of 2014 totalled US $12 million, and represented US 4 cents per share. The same amounts were declared for 2013.

During 2015, Sagicor will continue to focus on reducing operating costs, improving process efficiency and improving customer service through the rationalisation of its major operating centres.BM

Businessuite Markets3 weeks ago

Businessuite Markets3 weeks ago

Leadership Conversations4 weeks ago

Leadership Conversations4 weeks ago

Businessuite News246 days ago

Businessuite News246 days ago

Corporate Feature7 days ago

Corporate Feature7 days ago

Businessuite Women1 week ago

Businessuite Women1 week ago

Businessuite News24 International7 days ago

Businessuite News24 International7 days ago

Business Insights3 weeks ago

Business Insights3 weeks ago

Businessuite Markets1 week ago

Businessuite Markets1 week ago