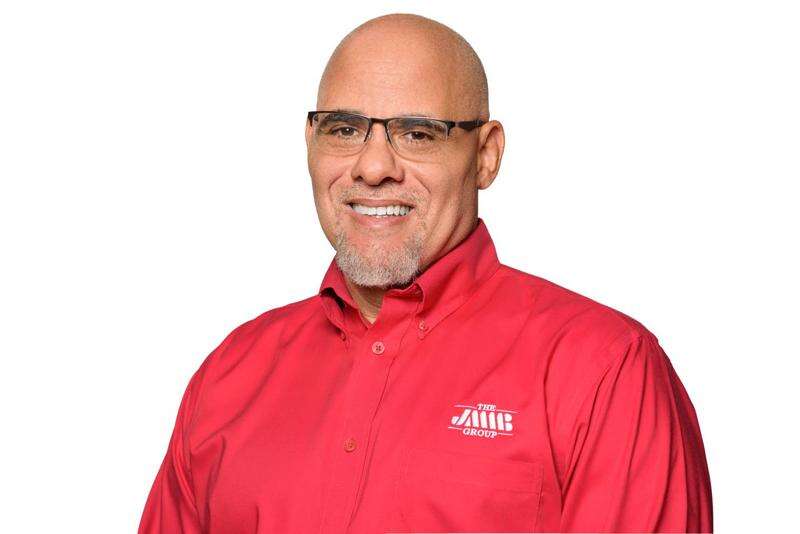

Keith P. Duncan Group Chief Executive Officer JMMB Group Limited has released the following Three Months Highlights for the period ended 30 June 2022 (Expressed in Jamaican dollars unless otherwise indicated)

Performance Highlights

• Net Operating Revenue J$6.55 billion, down 5%

• Net Interest Income J$2.91 billion, up 2%

• Net Profit J$1.97 billion, up 2%

• Earnings per Stock Unit J$0.98, up J$0.10

Group CEO’S Commentary

The JMMB Group posted solid results in the first quarter of its thirtieth year of operations. The Group continues to derive significant benefits from the consistent execution of its diversification strategy. The quarter’s performance is largely underpinned by the improved performance of key business lines in Trinidad and Tobago as well as the contribution of J$1.26 billion from its associated company, Sagicor Financial Company Limited (SFC).

Having come through the short to medium term shocks brought on by the pandemic over the last two years, the Group has managed to successfully pivot to a focus on growth in its major key performance indicators. The current financial year is now however, contextualized by rising global interest rate and an ongoing geopolitical crisis which has exacerbated global supply chain disruptions and commodity prices.

With this backdrop, the Group’s focus has been refined as “smart growth” which reflects driving growth from core operations and includes deriving the most from its operating territories which are rebounding and/or experiencing faster growth. While rising interest have negatively impacted gains on securities trading, the Group has reflected positive growth from net interest income, foreign exchange trading, income from capital markets and collective investment schemes as our clients continue to demonstrate confidence in our solutions and leverage our expertise.

Smart Growth – Revenue & Geographic Diversification, Strong Capital Management

The Group’s “smart growth” strategy now includes an emphasis on strategic revenue diversification, strong capital management, and growing core activities in key business lines. This has thus included a shift to the utilization of less capital, a focus on off balance sheet funds and deriving core revenue from FX gains, capital markets and the banking business line.

Additionally, the Group’s year over year first quarter growth in net profit was due in part to the 23.33% stake in SFC.

This acquisition continues to deliver considerable value to the Group and underscores the efficacy of the Group’ inorganic growth strategy.

Also contributing to this performance is the Group’s operations in the Dominican Republic which contributed 25% of operating revenue. This performance again underscores the continued value of the market and the Group’s continued and aggressive execution of its diversification strategy there.

In keeping with this is the most recent acquisition in the market by JMMB Holding Company SRL’s, a subsidiary of JMMB Group Limited, which acquired 100% shareholding in Dominican Republic-based Banco Múltiple Bell Bank SA, marking the Group’s entry into the market’s commercial banking sector. With this acquisition, the Group’s operations in this territory are now rounded out to include a full range of investment management services, pension funds management and commercial banking services.

Through this, the Group is now to set to further deepen its presence in the market inclusive of the roll out of a full range of online banking as well as niche card and payment solutions and services.

In the upcoming quarters, focus on geographic diversification will remain with sharp focus on Trinidad and Tobago, where the operating environment is currently more accommodative to growth. Business line diversification will also continue to be important with the fund management business line specifically targeted for growth through new and existing mutual fund products to support further diversification and financial goal attainment for clients.

Additionally, there will be a strategic focus on capital efficient growth from lending as well as opportunistic growth in the investment portfolio as well as an emphasis on revenue diversification as the Group expands its payments solutions suite with the roll out of e-commerce and niche card solutions in the upcoming quarter. With this, the Group expects to continue to deliver solid results and value to stakeholders for the remainder of the financial year.

Group Financial Performance

Net Operating Revenue

The JMMB Group posted net operating revenue of J$6.55 billion for the three months ended June 30, 2022, reflecting a decline of 5%. The operating environment was quite challenging when compared to the prior period. For one, there was rising inflation which reflected the war in Ukraine and the attendant increase in geo-political uncertainty; supply chain disruptions as well as other Covid-related factors. Central banks across the world, as a part of their inflation targeting regime, have responded by increasing interest rate and reducing market liquidity. This had a particularly negative effect on trading gains.

Trading gains fell by 58% to J$1B as given higher interest rates, investors were de-risking and as a result there was reduced demand for emerging market assets. Consequently, asset prices fell and trading activity was reduced. This was contrary to the prior period, then investor sentiment was high and interest rates were low.

Therefore, investors were in search of yields and there was high demand for emerging market assets. All other major revenue line items increased, especially fees and commission income. This was facilitated by increased economic activity as all the territories in which we operate are in recovery mode. In fact, the Dominican Republic has recovered to pre-pandemic levels. Thus, fees and commission income were 75% higher at J$1.67 billion and reflected significant growth in managed funds and collective investment schemes across the Group. Our clients continue to be reassured by our expertise and our dedication to ensuring that they meet their financial life goals. Further, our clients continue to demonstrate confidence in the value of solutions and services which was evidenced by strong growth in the loan and investment portfolios. Thus, net interest income moved from J$2.86 billion to J$2.91 billion.

Segment Contribution

The Banking & Related Services segment contributed J$3.23 billion or 50% of net operating revenue. This represented a 32% increase when compared to the prior period and reflected strong growth in the loan book which translated into increased net interest income. Also, there were higher trading gains and fees.

The Financial and Related Services segment contributed J$3.26 billion or 49% of net operating revenue and reflected a decline of 25%. This largely reflected lower trading gains.

Operating Efficiency

Operating expenses moved from J$4.72 billion to J$5.32 billion as we continued to grow in a cost-efficient manner. This included inflationary increases as well as strategic spend related to our longer-term initiatives aimed at improving the posture and positioning of the Group. Thus, operational efficiency moved from 69% to 81%. Nevertheless, we continued to focus on projects to cause scale and efficiency and thereby contribute to long term shareholder value.

Group Financial Position

Total Assets

At the end of the reporting period, the JMMB Group’s asset base totalled J$624.89 billion, up 2% relative to the start of the financial year. This was mainly on account of a larger loan portfolio which grew by 7% to J$152.5 billion. The credit quality of the loan portfolio continued to be comparable to international standards and we continue to maintain enhanced monitoring to mitigate against possible deterioration in credit quality.

Growth in the asset base over the three-month period was funded in part by increases in multilateral funding and repos. An additional tranche of funding was received from IDB Invest, a member of the Inter-American Development Bank Group. This is earmarked for the SME segment and will improve the capacity of the JMMB Bank (JA) to continue building its SME solutions suite. Also, repos grew by 2% to J$305.49 billion.

Capital

Over the three-month period, shareholders’ equity decreased by 10% to J$50.67 billion. Despite posting significant profit for Q1, this was completely offset by further decline in investment revaluation reserve. For the current reporting period, bond prices and by extension investment revaluation reserve continued to be negatively impacted by rising interest rates, increased global uncertainty, rising commodity prices as well as supply chain disruptions.

Nevertheless, the Group continues to be adequately capitalized and all individually regulated companies within the Group continues to exceed their regulatory capital requirements. The performance of the major subsidiaries is shown

in the table above.

Off-Balance Sheet Funds under Management

In alignment with the Group’s strategy to provide complete, customized financial solutions for each client, we experienced growth in our off-balance sheet products which include pension funds, unit trusts and money market funds.

The total invested in off-balance sheet products as at the end of June 2022 stood at J$190.08 billion compared to J$170.68 billion as at end of June 2021.

More information CLICK HERE

Businessuite News24 International2 years ago

Businessuite News24 International2 years ago

Feedback & What You Think2 years ago

Feedback & What You Think2 years ago

Marketing & Advertising2 years ago

Marketing & Advertising2 years ago

Businessuite Women1 year ago

Businessuite Women1 year ago

Businessuite 50 Power and Influence1 year ago

Businessuite 50 Power and Influence1 year ago

Businessuite Markets2 years ago

Businessuite Markets2 years ago

Leadership Conversations1 year ago

Leadership Conversations1 year ago

RANKING2 years ago

RANKING2 years ago

Globus Spirits Ltd is one of the leading players in the Alcohol industry in North India distributing brands in the Consumer Segment including:

Globus Spirits Ltd is one of the leading players in the Alcohol industry in North India distributing brands in the Consumer Segment including: renowned brands, including some of their own home-grown successes. The partnership marks a significant milestone in ANSA McAL Group’s journey, merging cultures and expertise to revolutionise the beer industry in India, with their icon Carib brand and leading the charge.

renowned brands, including some of their own home-grown successes. The partnership marks a significant milestone in ANSA McAL Group’s journey, merging cultures and expertise to revolutionise the beer industry in India, with their icon Carib brand and leading the charge.

The Group produced a net profit attributable to shareholders of $1.3 billion, for the quarter ended January 27, 2024. The operations of the Group continue to be strong, and our gross margins are consistent with expectations.

The Group produced a net profit attributable to shareholders of $1.3 billion, for the quarter ended January 27, 2024. The operations of the Group continue to be strong, and our gross margins are consistent with expectations.