Banks DIH Holdings Inc.

The Principal Activities of Banks DIH Limited (Group) are brewing, blending, bottling and wholesale marketing of beers, wines, liquors, and assorted beverages; the processing of food items; the operation of restaurants, bars, laundry services, hotel; the operation of commercial banking; transportation and alternative energy products and services.

On 18th January, 2023 the Directors incorporated a Holding Company by the name of Banks DIH Holdings Inc. (“BDIHHI”). The purpose of BDIHHI is to create a new corporate structure for the Banks DIH Group of Companies, which would facilitate the entry into new activities arising from the present rapid economic development in Guyana. This step was taken pursuant to the advice of the reputable accounting firm BDO, which operates in many countries in the Western World and has a Branch Office in St. Lucia.

Leadership

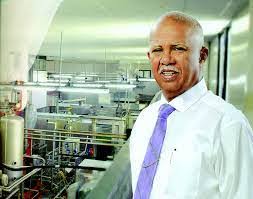

Clifford Barrington Reis, C.C.H.,

Chairman / Managing Director

Banks DIH Limited is a multi-billion-dollar company headed by Mr. Clifford Barrington Reis, CCH, who was appointed Chairman/Managing Director after the death of Mr. Peter S. D’Aguiar thereby heralding the dawn of a new era in the company’s history. Clifford Barrington Reis, is regarded as a veteran business executive who has been responsible for the stewardship of local bottling giants Banks DIH Limited for the past 29 years as Chairman/Managing Director.

Mr. Clifford Reis’ management style could be described as ‘hands-on’ and manages through consultation, help and advice from the Directors, Executive Board Members and the Worker Management Participation Board (W.M.P.B.). He believes that business must be undertaken with a sense of urgency and getting quality results is of the utmost importance.

Building Resilience Through People, Products, and Processes: A Strategy for Sustainable and Efficient Manufacturing

Revenue and Profits

The overall performance of the Group improved by recording a Profit before Tax of $14.509 billion compared to $13.398 billion in 2022, an increase of $1.111 billion or 8.29%.

Profit after Tax for the Group attributable to Shareholders of the Parent Company increased from $8.395 billion to $8.970 billion, an increase of $575.0 million or 6.8%.

Revenue generated by the Company was $44.048 billion compared to $39.653 billion in 2022, an increase of $4.395 billion or 11.1%.

The Profit before Tax for the Company was $11.393 billion compared to $10.506 billion achieved in 2022, an increase of $887.0 million or 8.4% while the Profit after Tax increased from $7.589 billion to $8.129 billion by $540.0 million or 7.1%.

The complexity of the Business Environment is escalating rapidly. In the wake of the ongoing Global recovery from the COVID-19 pandemic in 2023, we have encountered further challenges in the Global Landscape impacting our operations.

The Geopolitical Crisis in Europe continues to exert influence on commodity prices and Supply Chain Operations The Financial Year which ended on September 30, 2023 had many challenges which included Supply Chain Delays and increased costs for Raw and Packaging Materials, Spares, Energy, Distribution and the Retention of Skilled Employees.

Our strategy was centered around our Employees and Customers to drive Sustainable Solutions and build Resilience in our Manufacturing Processes, maintaining the production of High Quality Products and Efficiency in Operations.

Capital Expenditure

The Company continued to make Capital Investments in Plant, Machinery, and Equipment in order to strengthen long-term development, bolster our manufacturing capacity, and improve the operational efficiency.

Capital works were completed with the acquisition of a 120 HL Brew House to enhance the brewing capacity of our Malt Products. There was the acquisition of a Blow Moulder, Conveyors and Puncheons for the Rum Division, as well as a new on-line Blow Moulder for the Soft Drink Plant.

The Food Division was enhanced with Packaging Equipment, Spiral Mixers, Bag Sealing Unit, Conical Rounder and Temperature Control Equipment.

The Utility Services Areas within the Company which include Thirst Park Water Well, CO2 Plant, Central Quality Lab, Refrigeration and Material Handling were all upgraded with new equipment.

The Power Generation Plant was upgraded with new Switch Gears, the overhaul of Generators and the installation of Alternative Power Equipment.

Several of our Land Holdings and Buildings were upgraded including the Berbice Branch Bond, Special Events Outlet and the Linden Branch. Construction works continued on the Elevated Car Parking Facilities.

During the year, the Company acquired forty (40) acres of Land for the purpose of future development and expansion.

In our quest to deliver products to Customers, the Transport and Distribution Fleet was boosted with the acquisition of new Trucks and Forklifts. Hundreds of Customers in the Mom and Pop shops, Supermarkets and Grocery Stores and several Offices and Ministries were supplied with Coolers, Freezers and Water Dispensers.

The Information, Communication and Technology (ICT) Department was upgraded with new Computers and Power Solutions.

Businessuite Women2 weeks ago

Businessuite Women2 weeks ago

Businessuite News244 weeks ago

Businessuite News244 weeks ago

Businessuite News24 International4 weeks ago

Businessuite News24 International4 weeks ago

Businessuite News243 weeks ago

Businessuite News243 weeks ago

Corporate Feature4 weeks ago

Corporate Feature4 weeks ago

Business Insights2 weeks ago

Business Insights2 weeks ago

Businessuite Markets3 weeks ago

Businessuite Markets3 weeks ago

Businessuite Women4 weeks ago

Businessuite Women4 weeks ago